Renters Insurance in and around Columbus

Columbus renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

- Columbus

- Upper Arlington

- Franklin County

- Dublin

- Delaware

- Grove City

- Westerville

- Hilliard

- Delaware County

- Madison County

- Grandview

- Lancaster

- Newark

- Springfield

- Reynoldsburg

- Pickaway County

- Fairfield County

- Licking County

- Union County

- Champaign County

- Knox County

- Logan County

There’s No Place Like Home

The place you call home is the cornerstone for everything you hold dear. It’s where you build a life with family and friends. Home is truly where your heart is. That’s why, even if you live in a rented property or home, you should have renters insurance—even if your landlord doesn’t require it. It's coverage for the things you do own, like your running shoes and silverware... even your security blanket. You'll get that with renters insurance from State Farm. Agent Steve Rider can roll out the welcome mat with the dedication and wisdom to help you make sure your stuff is protected. Personalized care and service like this is what sets State Farm apart from the rest. When you're covered by State Farm, your rental can be home sweet home.

Columbus renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Why Renters In Columbus Choose State Farm

Many renters underestimate the cost of refurnishing a damaged property. Your valuables in your rented condo include a wide variety of things like your coffee maker, dining room set, TV, and more. That's why renters insurance can be such a good decision. But don't worry, State Farm agent Steve Rider has the experience and dedication needed to help you choose the right policy and help you insure your precious valuables.

A good next step when renting a condo in Columbus, OH is to make sure that you're properly covered. That's why you should consider renters coverage options from State Farm! Call or go online now and discover how State Farm agent Steve Rider can help you.

Have More Questions About Renters Insurance?

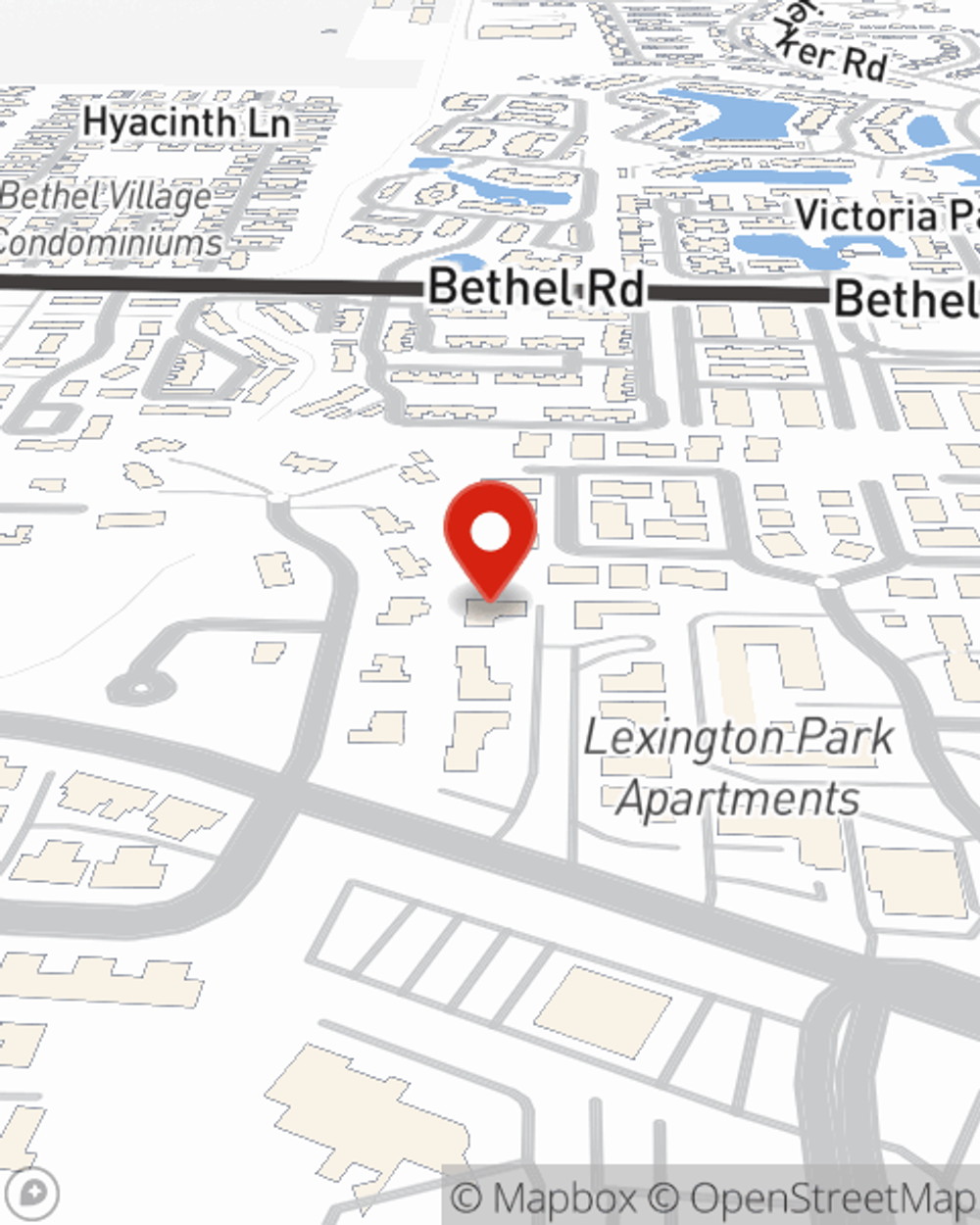

Call Steve at (614) 457-5070 or visit our FAQ page.

Simple Insights®

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

Steve Rider

State Farm® Insurance AgentSimple Insights®

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.